(Corporate bonds issued only in Croatia; this webpage is only in the Croatian language.)

Prikupljeni iznos

3.822.000 €

Preostalo za prikupiti

178.000 €

Preostalo do cilja

4 %

Informacije o trenutnom izdanju obveznica

- Iznos izdanja: €975.000

- Kamatna stopa: 6.25% godišnje

- Isplata kuponske kamatne stope: polugodišnje

- Isplata glavnice: jednokratno na kraju izdanja nakon 3 godine

- Vrste obveznica: standardna i konvertibilna

- Minimalni upis standardna: €1.000

- Minimalni upis konvertibilna: €50.000

- PRIIP-KID – HRPLGRO28BA6

- Iznos izdanja: €975.000

- Kamatna stopa: 6.25% godišnje

- Isplata kuponske kamatne stope: polugodišnje

- Isplata glavnice: jednokratno na kraju izdanja nakon 3 godine

- Vrste obveznica: standardna i konvertibilna

- Minimalni upis standardna: €1.000

- Minimalni upis konvertibilna: €50.000

- PRIIP-KID – HRPLGRO28BA6

Zainteresirani ulagači trebaju popuniti

obrazac za upis

Rezultati 2025.

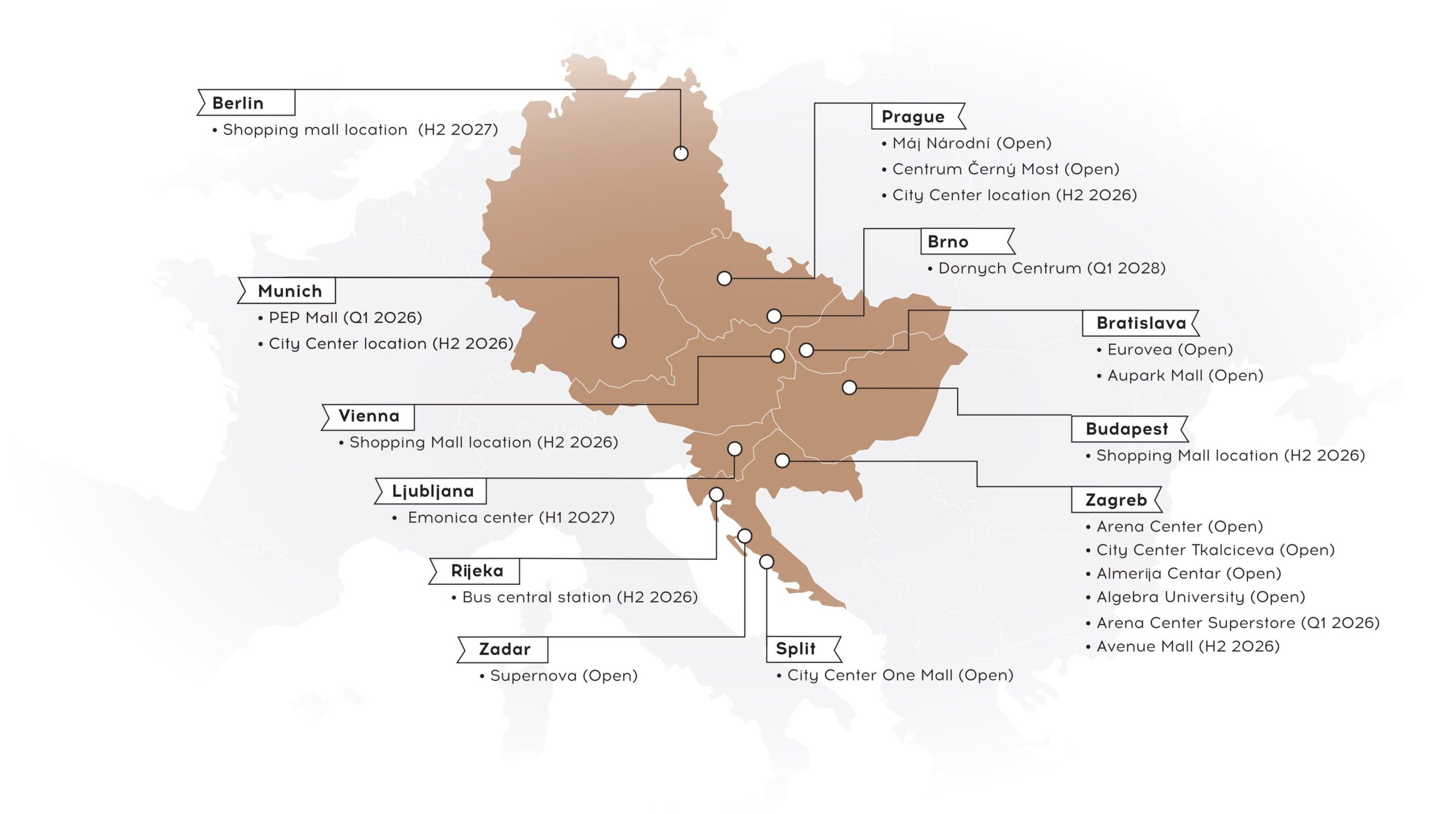

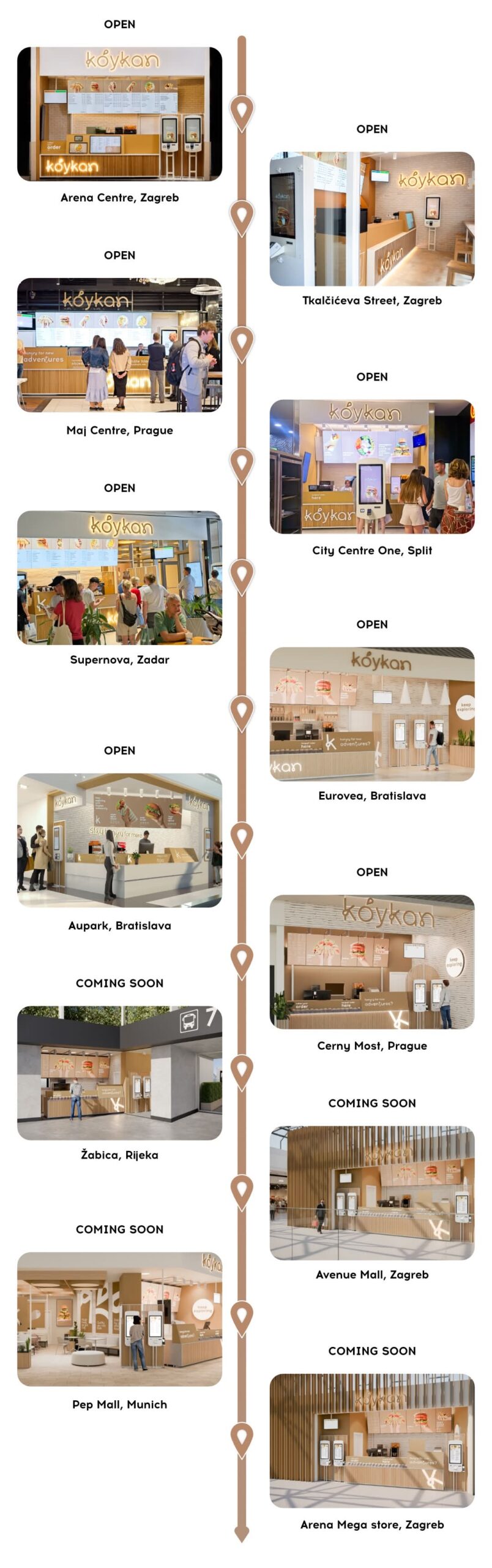

U 2025. uspješno smo otvorili 6 novih restorana i započeli izgradnju još 2 lokacije, čime ukupna mreža raste na 11 restorana u četiri zemlje regije – HR, DE, CZ i SK. Godišnji prihodi porasli su za 400% s €1.25 milijuna na €5 milijuna, dok je procijenjena EBITDA za 2026. (za postojeće poslovanje, bez rasta) viša od €1 milijuna, što potvrđuje učinkovitije poslovanje i snažan tržišni rast.

Ciljevi 2026.

Razvojnim izdanjem obveznica u 2026. fokusiramo se na tri ključna područja: širenje franšizne mreže, digitalnu transformaciju poslovanja i optimizaciju nabavnog lanca. Kroz nove ugovore s dobavljačima te izravnu kupovinu ambalaže i opreme od proizvođača dodatno ćemo povećati operativnu učinkovitost i profitabilnost te dugoročno ojačati konkurentnost Koykana.

Strategija 2026.

Početkom 2026. finalizirat ćemo osnivanje AIF fonda (Alternative Investment Fund) za financiranje otvaranja slijedećih 30 restorana, bez povećanja izravne zaduženosti poslovanja. Sredstva iz obvezničkog izdanja koristit ćemo isključivo za razvoj i povećanje profitabilnosti postojećeg lanca restorana. Planirana EBITDA osigurava redovitu isplatu postojećih kamata i kontinuirana ulaganja u rast te širenje mreže.

Velika HVALA svim dosadašnjim investitorima koji su omogućili širenje Koykan lanca na EU tržišta!

Pozdrav svim budućim investitorima i suvlasnicima Koykana!

💼 Koykan obveznice – investirajte u rast koji se događa

Koykan je otvorio razvojno izdanje obveznica u ukupnom iznosu od €750 tisuća, s godišnjim prinosom od 6.25% i rokom dospijeća od 3 godine.

Otvaramo 30 novih restorana u široj EU regiji u naredne 4 godine, s fokusom na Njemačku, Austriju, Češku, Slovačku, Mađarsku, Sloveniju i Poljsku. U Hrvatskoj ćemo postati nacionalni lanac prisutan u svim regijama i većim gradovima.

U posljednjih 6 mjeseci izgradili smo 6 novih lokacija (Prag x2, Bratislava x2, Split i Zadar), a četiri lokacije su trenutno u fazi izgradnje i otvaraju se u prvoj polovici 2026. godine (Minhen, Rijeka i Zagreb x2). Potpisali smo nove ugovore u Hrvatskoj, Češkoj i Sloveniji, s daljnjim planiranim lokacijama i širenjem mreže u regiji.

📌 Osnovne informacije o poslovanju:

- Broj lokacija: 15 restorana do kraja 2026. godine u DE, AT, CZ, SL, HU, SLO, HR

- Prosječni CAPEX po lokaciji: €250 tisuća

- Povrat investicije po lokaciji: 18–24 mjeseca

- Prihod po lokaciji: €750 tisuća – €1.5 milijuna godišnje

- Ciljani godišnji promet do 2027.: €13 milijuna

- Ciljani godišnji promet do 2035.: €100 milijuna

🔎 Zašto Koykan?

Koykan je street food lanac restorana s dokazanim poslovnim modelom, prisutan u više zemalja, s aktivnim franšiznim partnerima i konkretnim fit-out radovima u tijeku. Pročitajte više o Koykanu u priloženoj prezentaciji i financijskom pregledu. Više o tome kako management tvrtke komunicira s investitorima potražite na našoj Investor Relations web stranici.

📈 Što financiramo?

Prikupljenim kapitalom Koykan će financirati širenje operativne mreže u 8 zemalja regije, uključujući nove franšizne i vlastite lokacije. Time jačamo tržišnu poziciju i skaliramo sustav s visokim povratom i iznadprosječnom operativnom učinkovitošću.

🔄 Konvertibilne obveznice – prilika za vlasništvo

Obveznice uključuju opcionalnost konverzije u poslovne udjele pod jasno definiranim uvjetima (detalji u FAQ). To je jedinstvena prilika da postanete suvlasnik moderne hrvatske poduzetničke priče, koja raste regionalno i globalno – bez kompromisa na kvaliteti ili kontroli.

⚠️ Ključni rizici s kojima se susreće Koykan

Ulaganje u vrijednosne papire nosi sa sobom rizike. Investitori koji odluče uložiti svoja sredstava u obveznice Koykana trebaju biti upoznati s rizicima koje sa sobom nose vrijednosni papiri.

Kao i kod svakog ulaganja, postoje rizici uključujući promjene na tržištu hrane, operativne izazove u širenju maloprodajne mreže i moguće regulatorne izmjene u segmentu franšiznog poslovanja. Međutim, Koykan posluje kroz diverzificiran portfelj pomno odabranih lokacija i koristi tehnološki integriran sustav za nadzor poslovanja, čime se značajno smanjuju operativni i financijski rizici. Investitori se trebaju upoznati detaljno s rizicima koji su opisani na ovoj web stranici.

🧾 Što dalje?

Zainteresirani ulagači trebaju popuniti obrazac u nastavku.

Nakon zaključenja knjige upisa, bit će poslan poziv na uplatu.

Obveznice će se upisati u SKDD (Središnje klirinško depozitarno društvo), a svi investitori će dobiti službenu potvrdu o upisu i stanju na računu. Ako još nemate račun u SKDD-u, on će biti automatski otvoren na vaše ime.

💼 Koykan obveznice – investirajte u rast koji se događa

Koykan je otvorio razvojno izdanje obveznica u ukupnom iznosu od €750 tisuća, s godišnjim prinosom od 6.25% i rokom dospijeća od 3 godine.

Otvaramo 30 novih restorana u široj EU regiji u naredne 4 godine, s fokusom na Njemačku, Austriju, Češku, Slovačku, Mađarsku, Sloveniju i Poljsku. U Hrvatskoj ćemo postati nacionalni lanac prisutan u svim regijama i većim gradovima.

U posljednjih 6 mjeseci izgradili smo 6 novih lokacija (Prag x2, Bratislava x2, Split i Zadar), a četiri lokacije su trenutno u fazi izgradnje i otvaraju se u prvoj polovici 2026. godine (Minhen, Rijeka i Zagreb x2). Potpisali smo nove ugovore u Hrvatskoj, Češkoj i Sloveniji, s daljnjim planiranim lokacijama i širenjem mreže u regiji.

📌 Osnovne informacije o poslovanju:

- Broj lokacija: 15 restorana do kraja 2026. godine u DE, AT, CZ, SL, HU, SLO, HR

- Prosječni CAPEX po lokaciji: €250 tisuća

- Povrat investicije po lokaciji: 18–24 mjeseca

- Prihod po lokaciji: €750 tisuća – €1.5 milijuna godišnje

- Ciljani godišnji promet do 2027.: €13 milijuna

- Ciljani godišnji promet do 2035.: €100 milijuna

🔎 Zašto Koykan?

Koykan je street food lanac restorana s dokazanim poslovnim modelom, prisutan u više zemalja, s aktivnim franšiznim partnerima i konkretnim fit-out radovima u tijeku. Pročitajte više o Koykanu u priloženoj prezentaciji i financijskom pregledu. Više o tome kako management tvrtke komunicira s investitorima potražite na našoj Investor Relations web stranici.

📈 Što financiramo?

Prikupljenim kapitalom Koykan će financirati širenje operativne mreže u 8 zemalja regije, uključujući nove franšizne i vlastite lokacije. Time jačamo tržišnu poziciju i skaliramo sustav s visokim povratom i iznadprosječnom operativnom učinkovitošću.

🔄 Konvertibilne obveznice – prilika za vlasništvo

Obveznice uključuju opcionalnost konverzije u poslovne udjele pod jasno definiranim uvjetima (detalji u FAQ). To je jedinstvena prilika da postanete suvlasnik moderne hrvatske poduzetničke priče, koja raste regionalno i globalno – bez kompromisa na kvaliteti ili kontroli.

⚠️ Ključni rizici s kojima se susreće Koykan

Ulaganje u vrijednosne papire nosi sa sobom rizike. Investitori koji odluče uložiti svoja sredstava u obveznice Koykana trebaju biti upoznati s rizicima koje sa sobom nose vrijednosni papiri.

Kao i kod svakog ulaganja, postoje rizici uključujući promjene na tržištu hrane, operativne izazove u širenju maloprodajne mreže i moguće regulatorne izmjene u segmentu franšiznog poslovanja. Međutim, Koykan posluje kroz diverzificiran portfelj pomno odabranih lokacija i koristi tehnološki integriran sustav za nadzor poslovanja, čime se značajno smanjuju operativni i financijski rizici. Investitori se trebaju upoznati detaljno s rizicima koji su opisani na ovoj web stranici.

🧾 Što dalje?

Zainteresirani ulagači trebaju popuniti obrazac u nastavku.

Nakon zaključenja knjige upisa, bit će poslan poziv na uplatu.

Obveznice će se upisati u SKDD (Središnje klirinško depozitarno društvo), a svi investitori će dobiti službenu potvrdu o upisu i stanju na računu. Ako još nemate račun u SKDD-u, on će biti automatski otvoren na vaše ime.

Obrazac za upis obveznica

Informacije o trenutnom izdanju

- Iznos izdanja: €975.000

- Kamatna stopa: 6.25% godišnje

- Isplata kuponske kamatne stope: polugodišnje

- Isplata glavnice: jednokratno na kraju izdanja nakon 3 godine

- Vrste obveznica: standardna i konvertibilna

- Minimalni upis standardna: €1.000

- Minimalni upis konvertibilna: €50.000

Sažetak investicijske prilike

FAQ (česta pitanja)

Kamatna stopa na Koykan obveznice određena je u skladu s ciljem da investitorima ponudi atraktivan, ali održiv prinos, s obzirom na stabilne novčane tokove koje Društvo ostvaruje kroz lanac vlastitih i franšiznih QSR (quick service restaurant) lokacija. Koykan posluje u više gradova s dokazanim unit economics modelom i kratkim povratima uloženog kapitala od prosječno dvije godine.

Minimalni iznos ulaganja iznosi 1.000 EUR, što Koykan korporativne obveznice čini dostupnima širokom krugu ulagatelja, uključujući male ulagače i privatne osobe.

Ulaganje u vrijednosne papire nosi sa sobom rizike. Investitori koji odluče uložiti svoja sredstava u obveznice Koykana trebaju biti upoznati s rizicima koje sa sobom nose vrijednosni papiri. Detaljni opis rizika koje Koykan smatra relevantnima nalazi se na ovoj web stranici.

Koykan već danas koristi višekanalni pristup financiranju, uključujući bankovne kredite, leasing modele, privatne investitore, kao i generiranje pozitivnog operativnog cash flowa iz postojećih lokacija. Društvo je definiralo ciljani minimalni iznos ulaganja te već osiguralo financiranje za taj prag, što dodatno potvrđuje sigurnost i uspjeh ovog izdanja.

Da. Koykan se obvezuje na redovno i transparentno izvještavanje ulagatelja putem polugodišnjih poslovnih izvještaja, u kojima će biti prikazani ključni operativni i financijski pokazatelji relevantni za nositelje obveznica.

Da, Društvo može, uz prethodnu najavu i pod uvjetima definiranim u dokumentaciji izdanja, izvršiti prijevremenu otplatu obveznica. U tom slučaju, ulagatelji zadržavaju pravo na isplatu glavnice i kamate do dana prijevremene otplate.

Koykan izdaje dvije vrste obveznica:

1. Konvertibilnu obveznicu, koja uključuje opciju zamjene u poslovne udjele Društva, i

2. Standardnu obveznicu, bez prava na konverziju, koja se otplaćuje u skladu s uvjetima dospijeća.

Konvertibilne obveznice su vrsta obveznica koje ulagateljima omogućuju da svoj dug, po unaprijed definiranim uvjetima, pretvore u vlasničke udjele u društvu. Ovaj mehanizam smanjuje investicijski rizik, dok istovremeno nudi potencijal za veći dugoročni prinos. Upravo zato su konvertibilne obveznice atraktivne i za društva koja ih izdaju i za ulagatelje koji u njih ulažu.

Minimalni iznos ulaganja za konvertibilnu obveznicu iznosi 50.000 EUR. Ulagatelji koji ulažu taj ili veći iznos automatski stječu pravo korištenja mehanizma konverzije u poslovne udjele Društva.

Ulagatelji koji ulože manje od 50.000 EUR mogu sudjelovati putem standardne obveznice, no nemaju pravo na konverziju u poslovne udjele. Njima se po dospijeću isplaćuje nominalna vrijednost obveznice sukladno uvjetima izdanja.

Da. Svi ulagatelji koji su uložili minimalno 50.000 EUR imaju pravo konvertirati ukupan ili dio nominalnog iznosa obveznice u poslovne udjele Društva, sukladno uvjetima konverzije.

Dodatno, zaposlenici Koykan grupe koji su u trenutku konverzije i dalje aktivno zaposleni, a koji su uložili i iznose manje od 50.000 EUR, također će imati mogućnost konverzije. Time Društvo aktivno potiče lojalnost, dugoročnu suradnju i izgradnju snažnih radnih timova.

Omjer konverzije računa se prema formuli:

(Iznos konverzije / Vrijednost Društva na dan konverzije) × 100 = postotak vlasničkog udjela

Na temelju toga određuje se broj poslovnih udjela koje investitor stječe.

Vrijednost Društva na dan konverzije određuje se prema prema zadnjem vrednovanju po kojemu su uložili investitori koji su uložili u vlasništvo poduzeća, ali samo ako je ta evaluacija jednaka ili viša od €6.250.000. Ako je vrijednost Društva u toj rundi manja od tog iznosa, primjenjuje se zaštitna minimalna (floor) vrijednost od €6.250.000, koja je određena kao vrijednost Društva iz posljednje investicijske runde 2023. godine.

Ako ne postoji novija službena equity runda do trenutka konverzije, automatski se primjenjuje floor valuacija od €6.250.000.

Equity runda u ovom kontekstu podrazumijeva novo ulaganje u poslovne udjele Društva koje je provedeno na transparentan način, uz prateću financijsku i poslovnu dokumentaciju te uz jasno utvrđenu evaluaciju Društva koja odražava tržišne uvjete u trenutku ulaganja.

Ulaganje u obveznice bit će pretvoreno u vlasničke udjele Društva putem optimalnog modela konverzije u trenutku dospijeća. Mehanizam konverzije bit će strukturiran ili izravno u poslovne udjele Društva ili kroz prijelaz Društva u dioničko društvo (d.d.), ili putem posebno osnovanog pravnog entiteta (SPV) koji će omogućiti ulagateljima vlasničko sudjelovanje. Odabrani model ovisit će o pravnim, regulatornim i operativnim okolnostima u trenutku konverzije, a svim ulagateljima bit će osigurana ekvivalentna ekonomska prava i proporcionalno vlasništvo.

Ako investitor ne želi konvertirati obveznicu do datuma dospijeća, Društvo je obvezno isplatiti cijeli nominalni iznos obveznice, zajedno s ugovorenom kamatom.

Da, ulagatelj može djelomično konvertirati svoju obveznicu, pod uvjetom da iznos koji se konvertira nije manji od 50.000 EUR. Ostatak obveznice može se zadržati do dospijeća, kada će biti isplaćen u skladu s važećim uvjetima izdanja.

Da, odluka o konverziji mora se donijeti najkasnije 6 mjeseci prije isteka obveznice, kako bi Uprava mogla pravovremeno pripremiti sve pravne i korporativne radnje za provedbu konverzije

Najkasnije 3 mjeseca prije dospijeća obveznica, Uprava Društva obvezuje se sazvati skupštinu s ciljem donošenja odluke o povećanju temeljnog kapitala izdavanjem novih poslovnih udjela. Time će se investitorima koji su uložili putem konvertibilne obveznice omogućiti ostvarenje prava na konverziju.

Nakon održane skupštine, Uprava će obavijestiti sve ulagatelje o detaljnom modelu konverzije, uključujući tehnički i vremenski okvir njene provedbe.

Uprava Društva obvezuje se poduzeti sve što je u njenoj moći kako bi se skupština održala pravovremeno i kako bi se donijele potrebne odluke za provedbu konverzije. Međutim, valja imati na umu da uvijek mogu postojati izvanredne okolnosti ili vanjski faktori koji mogu utjecati na tijek ili ishod tog procesa (npr. regulatorne promjene, sudski sporovi, imovinskopravne prepreke).

Ukoliko investitor ne ostvari pravo na konverziju iz bilo kojeg razloga, uključujući i vlastitu odluku, obveznica se tretira kao standardna obveznica, a Društvo će po dospijeću isplatiti njezinu nominalnu vrijednost sukladno uvjetima izdanja.

Trenutno je Koykan fokusiran na maksimiziranje pozitivnih novčanih tokova i širenje operativne mreže kroz vlastite i franšizne QSR lokacije. Kako u strukturi vlasništva nema institucionalnih investitora koji bi usmjeravali strateške odluke, Društvo zadržava punu autonomiju u vođenju poslovanja. U budućnosti, Koykan će nastaviti donositi sve poslovne odluke s ciljem maksimizacije povrata za svoje ulagatelje, te s jasnom ambicijom da u optimalnom trenutku realizira izlazak na burzu putem IPO-a. Istovremeno, Koykan posebno vrednuje male ulagatelje i teži postići maksimalni oblik transparentnosti prema njima, kako bi odnos povjerenja bio temeljen na jasnim informacijama i obostranom interesu za dugoročni uspjeh.